Well! Majority of people which I know is making a fortune either holding or trading Bitcoin. Buying and holding a Bitcoin for long-term essentially offers a huge profit. Moreover, the potential to double or triple one’s holding is often just a small trade away, when it comes to margin trading.

That’s the reason why most of the people are giving up on their jobs to trade Bitcoins and Altcoins whole day. Now, those who are new to buying bitcoin and trading bitcoin on exchanges might find this a bit challenging at first; however, trading bitcoin and other cryptocurrencies aren’t that complicated. So, let’s have a look at the basics of trading cryptocurrencies and examine the advantages and disadvantages of Margin Trading.

What is Margin Trading?

Margin Trading allows users to borrow money against their current funds to trade cryptocurrency “on margin” on an exchange. In simple words, users can leverage their existing cryptocurrency by lending funds to increase their buying power. Furthermore, Margin buying and selling are feasible because of the life of the leading marketplace. Lenders offer loans to the traders so that they can invest in larger quantities of coins, and creditors advantage from hobby on the loans.

What are the advantages of Margin Trading?

When everything seems to go in the right way, then the traders have the potential to earn a huge sum of money by leveraging capital via margin trading. Traders who understand risk management correctly should be able to avoid losing entire bankrolls in some of the trades. Moreover, traders have the potential to earn way more money by leveraging capital rather than by using their personal funds only.

What are the Limitations of Margin Trading?

Margin trading isn’t cheap, as the borrowed funds are subject to the high interest rates. Also, these charges are withdrawn automatically when a position is closed out.

Further, the trades that don’t go as planned often end up liquidated, resulting in a total loss.

How to begin trading Bitcoin and other Cryptocurrencies?

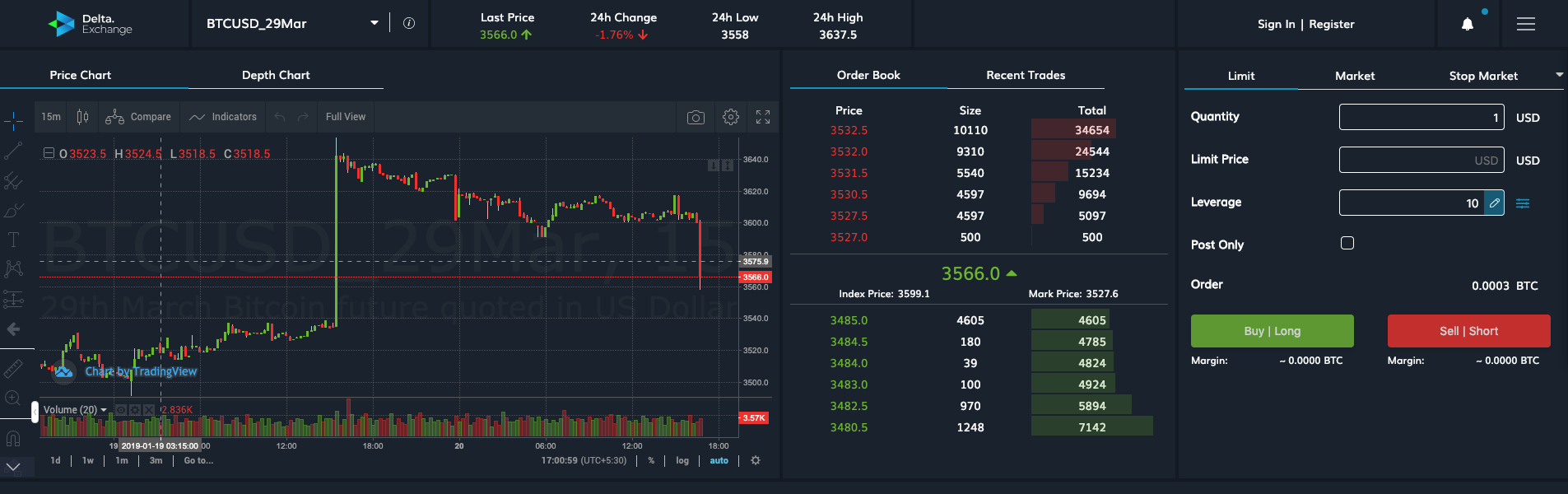

You need to purchase a Bitcoin and move it to your exchange of choice. Now as soon as Bitcoin appears in the exchange’s BTC wallet, it can now be traded for US dollars, other fiat cryptocurrencies, or on some trades, a wide range of Altcoins. For instance, you can trade ethereum futures easily on exchanges like Delta.

Moreover, it is not recommended to keep Bitcoin or other cryptocurrencies on exchange for more extended periods; however, day traders don’t have any other choices. Be very careful that this is just one of the many risks of trading cryptocurrencies.

Margin Trading Tips

Danger Management

When you are buying or selling on the margin it’s vital that there are clear regulations of threat control, always watch out for the immoderate greed. Consider the amount which you’re willing to threat. For ultimate ranges set clean ranges, taking earnings or prevent loss.

Watch Closely

Undoubtedly cryptocurrencies are considered as assets with immoderate volatility. And Margin trading of cryptocurrencies doubles the risk. Therefore, make a quick attempt for buying and selling leveraged positions. Now, even though every day margin function is negligible; however, in the long term, the charges can include quantity to a vast sum.

Intense Moves

We all know that Crypto margin trading has extreme fluctuations which arise in both directions. So, try to set closing target positions, which will leave a decent profit for you.

Margin Calls

In the case when a margin trade goes in the wrong direction, individuals will be required to add funds to their accounts to avoid order liquidation. However, if a trader is unable to provide further funds to secure the order, it will completely shut down automatically.

Bitfinex, CEX.IO, Whaleclub, GDAX, Bitmex are some who offer margin trading.

Note: Bitstamp will soon be offering margin trading soon; however, the currency it’s still in the closed BETA phase.

Margin Trading on Bitfinex

Traders can borrow $7 for every $3 they have in their accounts. Since Bitfinex is one of the biggest Bitcoin exchange in the world by volume, traders should start there.

Bitfinex Offers: 3.3:1 Margin Trading

Margin Trading on CEX.IO

The CEX.IO is one of the most popular options for traders, yet their verification process is demanding.

CEX.IO Offers: 3:1 Margin Trading

Margin Trading on Whaleclub

Whaleclub is a great place to be for traders who want to max out their margin trades.

Whaleclub Offers: 50:1 leverage on cryptocurrencies and 200:1 leverage on forex pairs

Margin Trading on GDAX

There number of hoops from where you have to jump through before you can margin trade. And this platform is geared more towards institutional investors with net worths of more than $1 million.

GDAX Offers: 3:1 Margin Trading

The Conclusion

In the end, traders have to decide how aggressively they want to be regarding trading strategy. Try to make things simple and make margin trading a profitable approach to earn a massive amount of money.

Now, when it comes to the margin trading, investors have the potential to earn more substantial profits than they would with liquid capital alone. The investors who can manage their margin trades properly can make more profit with Bitcoin & Altcoin Margin Trading.

Is margin trading for you? If you still looking for an answer, then the only way to know is by giving it a try. Start small and try to understand how the market moves.