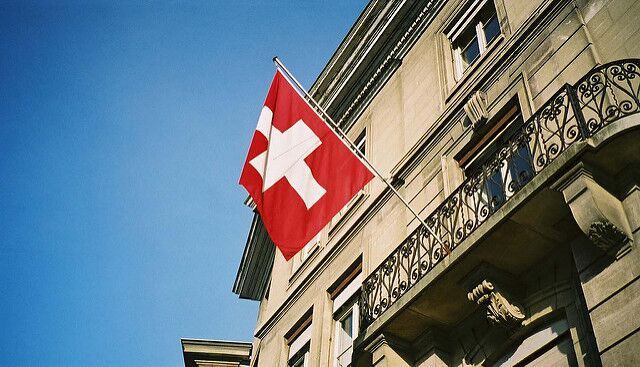

In an attempt to stop the exodus of financial innovation, Switzerland has finally made simple for firms working in the cryptocurrency and blockchain space to open corporate bank accounts.

As per the latest report by Reuters, published guidelines on Friday to banks who want to do business with 500+ blockchain and crypto startups situated in Zurich and Zug. The place is also referred to as Switzerland's crypto valley.

Earlier, some of the cryptocurrency firms were only enabled to deposit the cash acquired via Initial Coin Offerings (ICOs), because banks have already feared that this would casually lead to breaching anti-money laundering (AML) rules and other regulations.

Also Read: Brazil’s Biggest Brokerage to launch a Crypto Exchange

According to the new rules, there are new know-your-customer and AML checks suggested particularly customized for ICOs which raised funds in fiat currencies, and for all those who raised via digital currencies such as Ethereum (ETC). Moreover, the Swiss Bankers Association (SBA) has stressed that banks use discretion to distinguish between startups working on blockchain technology and cryptocurrency companies which conducted an ICO.

The summary suggested know-your-customer and AML checks for ICOs which raise funds in fiat currencies like Swiss francs, euros and dollars and all those who raise funds with it.

Adrian Schatzmann, SBA's Strategic advisor, stared in a press conference, “We believe that with these guidelines, we’ll be able to establish a basis for discussion between banks and innovative startups, making the dialogue simpler and facilitating the opening of accounts.”

Also Read: Brave Browser now verify publishers using Civic’s Blockchain Platform

The SBA assumes these new guidelines will offer clarity to banks as well as blockchain and cryptocurrency companies wanting to use traditional banking services for day-to-day activities.

Until now, the discussions with the banks have remained well, as per the SBA Deputy Chief Executive August Benz. However, it is still not known how they will respond to the new rules.