The Genesis Investing System is a trading system that involves investing private equity into startup companies and will not put any a single dollar of risk into the stock market.

You can learn more about the Genesis Investing System by signing up for a fully interactive online course called the Early Stage Playbook by Crowdability, which teaches you how to invest in startup companies using a simple three-step profit plan called the A.S.E. Process.

The Genesis Investing System presents bold forecasts about its potential gains, referring to the short report where a former Lehman Brothers executive unveils one of Wall Street’s best kept secrets: “a proven system that anyone could successfully use this system to turn $500 into $650,000 (or more)” using the Allocate, Screen and Evaluate process that helps investors follow the smart money.

Crowdability, which is an equity crowdfunding research and education program by Matthew Milner and Wayne Mulligan, is just now launching The Genesis Investing System in May 2020.

It goes on to say why this Genesis Investment System is responsible for the most profitable investment of all time. And that the mainstream press is even starting to catch-on, saying, The Wall Street Journal reports that this strategy “blows open the doors to investing…”. Then Forbes says that it “changes everything.”

Is The Genesis Investing System legit? Should you sign up for Crowdability's Early Stage Playbook course? Let’s take a closer look at how The Genesis Investing System works.

Learn More about the Genesis Investing System

What is The Genesis Investing System?

The Genesis Investing System is an investing system geared to help offer potentially huge gains for ordinary investors that one to take full advantage of the opportunities in the private markets.

You can discover how Genesis Investing works by signing up for the Early Stage Playbook today. The Early Stage Playbook is a multi-tier online course priced between $40 and $80.

While some may refute that Genesis investing isn’t some top secret strategy – being that genesis investing is a term for buying private equity in companies before they go public – but by investing in the right companies at the right times, you can earn enormous gains with the right insights and analysis.

The people who invested in Uber, Facebook, Amazon, and Apple before they went public, for example, enjoyed enormous gains. They purchased equity in companies at below-market prices, then reaped huge rewards when the companies went public.

The sales page for The Genesis Investing System mentions gains of 200,000% on a single investment among other massive wins. It also mentions an ordinary guy “who turned $5,000 into $2 million from his kitchen table” with genesis investing strategies.

Of course, there’s a problem with genesis investing: most ordinary people can’t invest private equity into companies before they go public. Most people need to wait for a company to go public before they can invest.

However, The Genesis Investing System appears to have identified a loophole that allows ordinary investors to buy private equity in companies before they go public and join in on the once-private closed-door nature of the private market.

By following the strategies in The Genesis Investing System, you can buy private equity in companies before they go public, then reap huge rewards as the company grows.

“Imagine turning $1,000 into $364,705 – with one investment,” explains the sales page.

Of course, there’s another problem with genesis investing: many investments are unsuccessful. For every Uber, Amazon, or Facebook, there are 1,000 companies that you’ve never heard of. People invested money into all of these companies – and lost it all.

Despite the high-risk nature of genesis investing, The Genesis Investing System sales page makes enormous claims about how ordinary people like you can turn a $10,000 investment into “$5 million”.

To learn about The Genesis Investing System, you need to sign up for the Early Stage Playbook.

What is The Early Stage Playbook?

The Early Stage Playbook is an online course that teaches you about genesis investing. The course is priced between $40 and $80. It’s marketed to ordinary investors who want to learn about genesis investing and other topics.

The course includes 12 video lessons. Crowdability created the course with the help of 30 professional venture capitalists and angel investors, including investors who made early stage investments in Twitter, Uber, LifeLock, and Apple.

Some of the topics covered by the Early Stage Playbook online course include pre-IPO investments, mutual funds for startups, how to use equity crowdfunding platforms, and more.

The Early Stage Playbook is an online course offered by Crowdability, a New York-based company. That company specializes in creating online training programs and tools that help investors navigate the new JOBS Act.

How the JOBS Act Opens Private Equity to Individual Investors

Historically, individual investors were not able to invest private equity into companies. Instead, you had to be an accredited investor, venture capital firm, or similar institution.

Thanks to the JOBS Act, however, individual investors can now buy private equity in companies. That means individual investors can buy stakes in the next Uber or Amazon before they become publicly traded.

The Jumpstart Our Business Startups Act (JOBS Act) was designed to encourage funding of small businesses in the United States by easing many of America’s securities regulations. President Obama signed the JOBS Act into law on April 5, 2012.

The JOBS Act has a section called the CROWDFUND Act that has drawn significant public attention. It creates a way for companies to use crowdfunding to issue securities, something that was not previously permitted.

In short, the JOBS Act makes it easier for businesses to crowdfund. It allows businesses to sell private equity to smaller investors instead of relying on venture capital firms and larger institutional investors.

Crowdability launched its Early Stage Playbook training course to help investors navigate the new, unfamiliar world of the JOBS Act.

What’s Included with Early Stage Playbook?

Early Stage Playbook consists of 12 interactive video lessons. These videos cover all of the following topics:

Tutorials for the Leading Equity Crowdfunding Platforms: Early Stage Playbook teaches you how to use the top equity crowdfunding platforms available today.

60 Minute Angel Investor: Early Stage Playbook teaches you how to become an angel investor in 60 minutes. It explains how to screen, evaluate, and invest in the best early-stage companies in under an hour.

Double Digit Returns in Private Income: Early Stage Playbook teaches you three low-risk private market investments that yield up to 17%.

Mutual Fund for Startups: Early Stage Playbook explains how to create your own mutual funds for startups by investing in eight promising startups that were vetted by professional VCs.

20 Pre-IPO Investments: Early Stage Playbook shares one investment that gives you a stake in 20 later stage private companies on the verge of IPOs.

Early Stage Investment Case Studies: The course shares two early stage investment case studies, walking you through the process of investing in these companies step by step.

Learn More about The Genesis Investing System

Early Stage Playbook Pricing

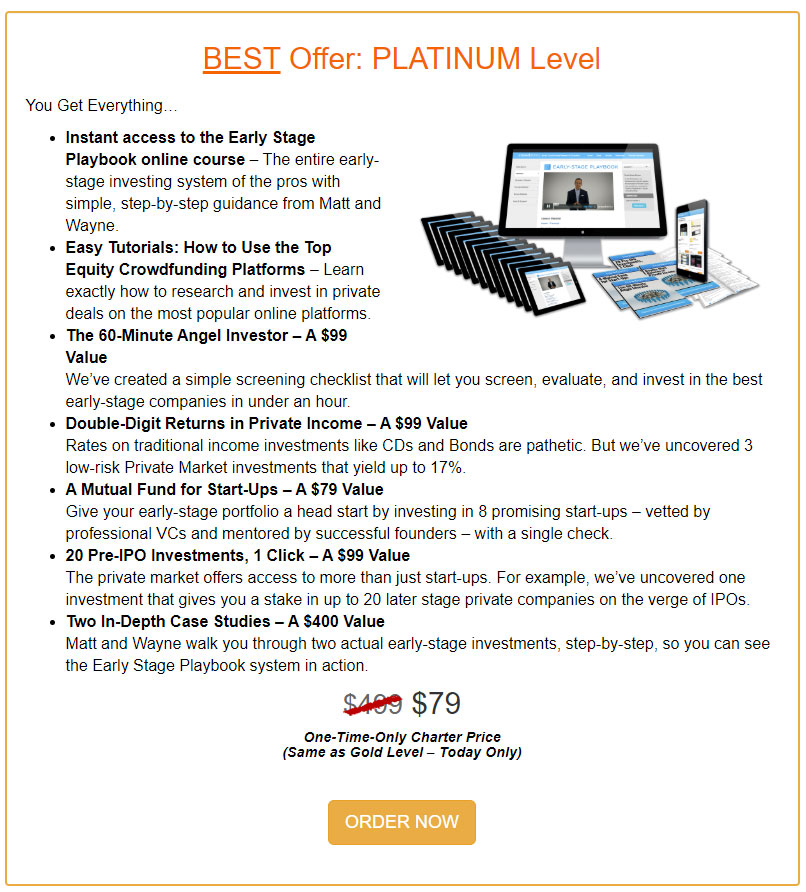

Early Stage Playbook is available at three tiers, including Platinum, Gold, and Silver.

Platinum ($79)

- Instant access to the Early Stage Playbook online course

- Access to all bonuses

Gold ($79)

- Instant access to the Early Stage Playbook online course

- Access to all bonuses except the case studies

Silver ($39)

- Instant access to the Early Stage Playbook online course

- Access to the crowdfunding platform tutorials

Early Stage Playbook Refund Policy

Your purchase comes with a 30 day money back guarantee. If you are unsatisfied with the Early Stage Playbook online course for any reason, then you can request a complete refund with no questions asked.

About Crowdability

Crowdability is an online company based in New York. The company offers online training modules and tools to help investors navigate the JOBS Act.

The company claims to be the world’s first and largest online research firm focused on startup investing. They claim to have 100,000 free and paid subscribers.

Crowdability’s flagship online course is The Early Stage Playbook, a 12-lesson video series that teaches novice investors everything they need to know about investing in early-stage companies.

Crowdability also offers a stock screener platform called CrowdabilityIQ, which rates and ranks hundreds of private equity investment opportunities from across the internet. The data and screening software claims to be the first of its kind, giving investors a fast and easy way to avoid risky startups and focus on startups with the most potential.

Crowdability is based at 205 Hudson Street in New York City. The company is led by Matthew Milner (a media and technology executive and former Bear Stearns and Lehman Brothers employee) and Wayne Mulligan (a financial media executive with experience on Wall Street and tech startups).

You can contact Crowdability via 1-844-JOBS-ACT (or 1-844-562-7228).

Final Word

The Genesis Investing System is a new online investment platform put together by Crowdability's Matt Milner and Wayne Mulligan. Crowdability offers training modules and tools to help ordinary investors navigate the JOBS Act, which allows ordinary investors to buy private equity in startups.

To learn more about the Genesis Investing System, you need to buy Crowdability’s flagship online course, the Early Stage Playbook, which is priced at $40 to $80 online. The course includes 12 interactive videos that walk you through the process of early stage investing.

Crowdability makes some bold claims about its earning potential online, claiming ordinary investors can generate huge returns by following their investment recommendations. However, Crowdability also offers a generous refund policy on its Early Stage Playbook (30 day full money back guarantee), which means you can try the course and decide if it’s right for you.